Our Approach

We approach working with our clients using a purposeful and effective processes. These processes have proven to yield the best results because they are highly customized to each individual client. We take our time and great care in every phase to make sure we get it right so that the results from implementation continuously match the client’s goals and objectives.

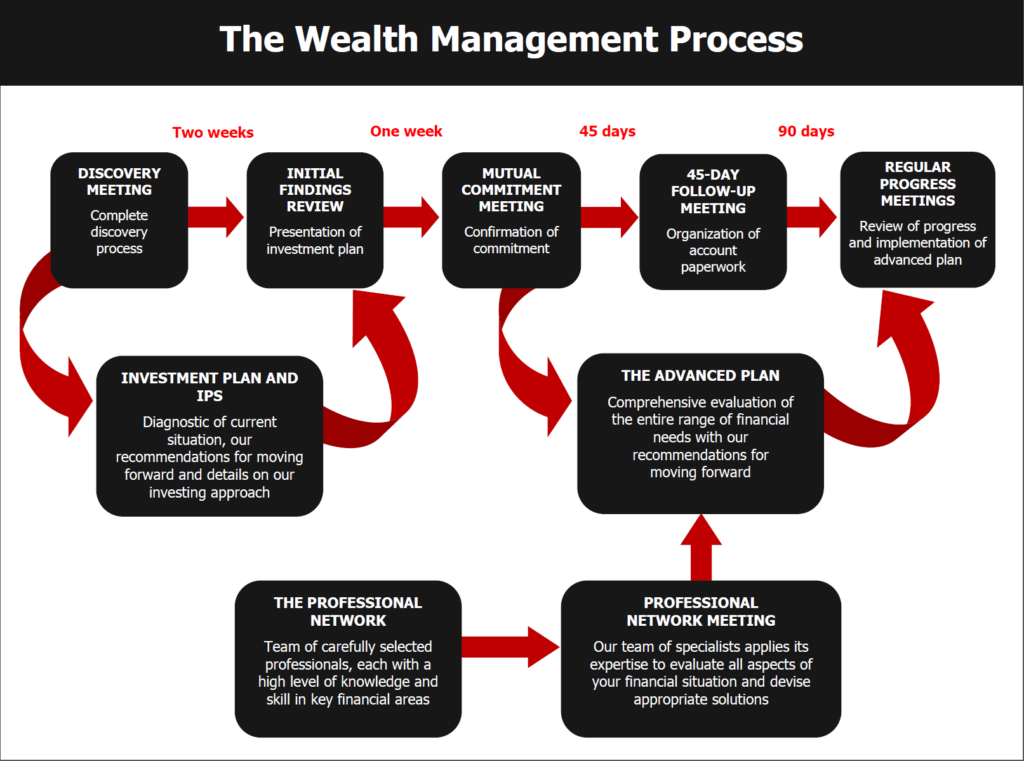

Our Wealth Management Consulting Process

Fischer Financial Services uses the following systematic consulting process for uncovering your most important goals and for designing and implementing appropriate solutions.- Discovery Meeting. At our initial meeting, we conduct a discovery interview. This helps us identify the challenges you face in achieving all that is important to you. We examine your current situation, the goals you would like to achieve and how we can maximize the possibility of achieving those goals.

We will ask you a series of questions to really understand what is most important to you, what you would like to accomplish and what keeps you awake at night. We will determine where you are now, where you want to be and any gaps or obstacles that stand in the way. It’s our chance to get a very clear picture of you so that we can guide you in how best to achieve your most important goals. - Investment Plan Meeting. At this meeting, we present our diagnostic of your current situation and our recommendations for how we can bridge the gaps in order for you to reach your goals. This plan forms the foundation for all of our work together.

- Mutual Commitment Meeting. At this meeting, we are ready to make a mutual decision about whether our firm can add substantial value and whether we should proceed. Should we both choose to work together, we commit to each other to work toward achieving everything that is important to you and your family. We also execute the documents necessary to put your investment plan into motion.

- 45-Day Follow-up Meeting. When you have multiple investment accounts, it’s easy to become overwhelmed with the amount of paperwork you receive. At this meeting, we help you organize all that paperwork in a notebook that we provide. We also answer any questions you may have so that you understand exactly what is happening with your money.

- Regular Progress Meetings. These meetings, which we schedule at intervals convenient to you, provide us an opportunity to review any major changes in your personal or financial situation since our last meeting. If these changes mean that we need to make adjustments to your investment plan, we do so. We also review your overall progress toward your long-term financial goals. This meeting is also our opportunity to implement advanced planning recommendations that may be appropriate for your situation. We will present to you our advanced plan at our first Regular Progress meeting so that we can prioritize those areas of greatest importance to you and then begin to address them systematically.

Our Role as Your Personal Chief Financial Officer

This consulting process serves as our framework, but it is only the beginning. To ensure that your family’s most important financial issues are addressed as needed, we serve as your personal chief financial officer.

As your personal chief financial officer, we set the foundation of your financial house through this investment plan. Once this is in place, we address additional components of your financial picture as needed. With your wealth management plan to guide us, we focus on four broad areas of your financial life:

- Wealth preservation aims to produce the best possible investment returns consistent with your level of risk tolerance and time frames.

- Wealth enhancement minimizes the tax impact on your financial returns and overall plan.

- Wealth transfer intends to find and facilitate the most tax-efficient way to pass assets to succeeding generations, and to do so in a way that meets your wishes.

- Wealth protection is aimed at protecting your wealth against potential creditors, litigants, children’s spouses and potential ex-spouses.

- Charitable giving helps fulfill your charitable goals and is most effective when coordinated with the four services above.

Our Network of Professional Advisors

To gain the precise expertise we need to serve as your personal chief financial officer and effectively manage all aspects of your financial affairs, we work with a network of professional advisors. These carefully selected professionals provide us with a high level of knowledge and skill in key aspects of your finances. As your wealth manager, we review your complete financial picture and identify any needs. As appropriate, we then turn to our network in order to evaluate your specific financial challenges and devise appropriate recommendations.

Our advanced planning team reviews client plans, conducts a gap-analysis, and provides specific recommendations as an additional service with no extra cost. This team includes:

- Lawyers

- Accountants

- Business Insurance Risk Specialists

Customer Commitment

We commit to unwavering transparency, complete honesty, and a highly confidential relationship while delivering world-class financial services in our Victoria community. When you are successful, we are successful.

Life is a moving target. When we design and implement a financial plan for you, we make sure it’s flexible, accountable and adaptable. One of the things you can be assured of working with us, is having an exceptional team of people working hard to earn and keep your trust as we pursue your vision and goals of the future together.

“My wife Debbie and I have been clients of Fischer Financial Services since 2008. I first met Vern Fischer at a pilot training course and was immediately drawn in by some pretty obvious attributes: 1) friendly demeanor; 2) quiet and personable communication; and 3) sincerity. I was skeptical about using another financial planning service given our very negative experience dealing with poorly trained and overly aggressive branch personnel from one of the large national firms. Vern quickly put our concerns to rest by demonstrating his thorough knowledge of this industry, customer focus, soft coaching skills, and most importantly … honesty … through his actions and impressive results.’ – Jamie Sargent