Wealth Management

Our Wealth Management Program is designed for high-net-worth individuals and families, as well as corporations.

With increased wealth come increased options for managing a properly diversified portfolio. We believe the best results for our clients are achieved through a personalized investment portfolio based on your risk tolerance and goals. Your portfolio is designed and managed by your own private client internationally licensed, certified financial analyst portfolio manager who is accountable to you. Investment alternatives that are not typically available at the mass retail level now become available to you, such as segregated managed accounts and private investment pools.

At Fischer Financial Services, we are committed to the most effective way to build your wealth: protecting your income, minimizing your largest expenses, and acquiring cash-generating assets. Building wealth is through ownership of profitable businesses that practice continual reinvestment and pay a large and growing dividend stream. We are experienced in helping our clients manage these tasks most effectively to help them grow their wealth.

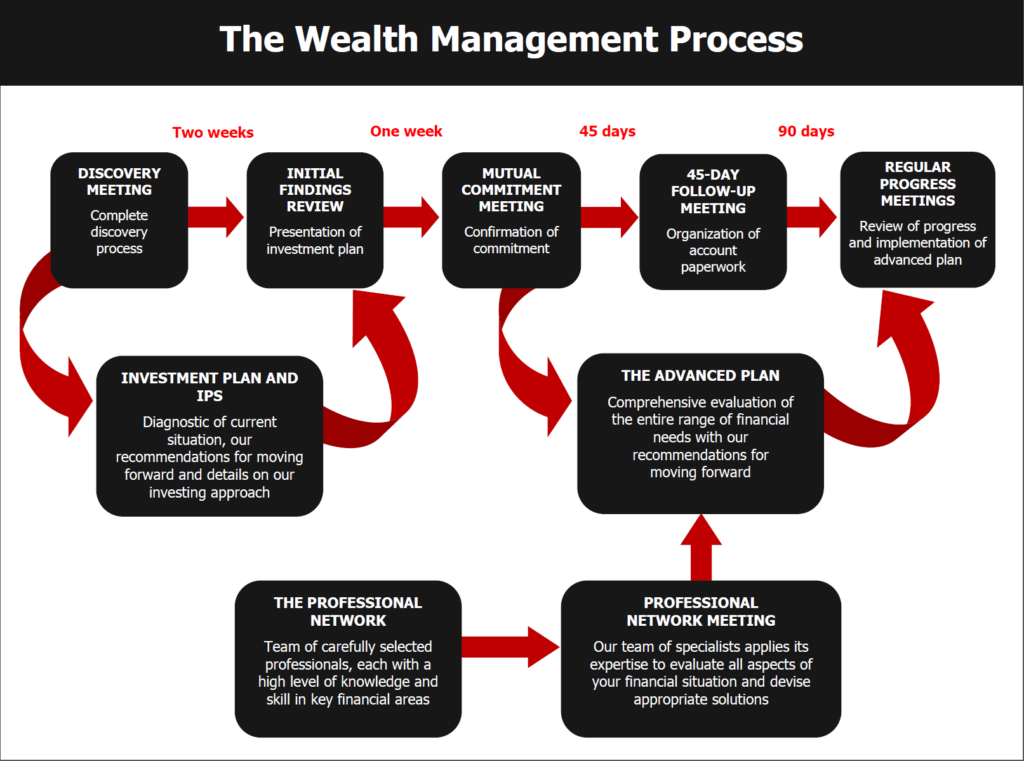

Our Wealth Management Consulting Process

Fischer Financial Services uses the following systematic consulting process for uncovering your most important goals and for designing and implementing appropriate solutions.

- Discovery Meeting. At our initial meeting, we conduct a discovery interview. This helps us identify the challenges you face in achieving all that is important to you. We examine your current situation, the goals you would like to achieve and how we can maximize the possibility of achieving those goals.

We will ask you a series of questions to really understand what is most important to you, what you would like to accomplish and what keeps you awake at night. We will determine where you are now, where you want to be and any gaps or obstacles that stand in the way. It’s our chance to get a very clear picture of you so that we can guide you in how best to achieve your most important goals. - Investment Plan Meeting. At this meeting, we present our diagnostic of your current situation and our recommendations for how we can bridge the gaps in order for you to reach your goals. This plan forms the foundation for all of our work together.

- Mutual Commitment Meeting. At this meeting, we are ready to make a mutual decision about whether our firm can add substantial value and whether we should proceed. Should we both choose to work together, we commit to each other to work toward achieving everything that is important to you and your family. We also execute the documents necessary to put your investment plan into motion.

- 45-Day Follow-up Meeting. When you have multiple investment accounts, it’s easy to become overwhelmed with the amount of paperwork you receive. At this meeting, we help you organize all that paperwork in a notebook that we provide. We also answer any questions you may have so that you understand exactly what is happening with your money.

- Regular Progress Meetings. These meetings, which we schedule at intervals convenient to you, provide us an opportunity to review any major changes in your personal or financial situation since our last meeting. If these changes mean that we need to make adjustments to your investment plan, we do so. We also review your overall progress toward your long-term financial goals. This meeting is also our opportunity to implement advanced planning recommendations that may be appropriate for your situation. We will present to you our advanced plan at our first Regular Progress meeting so that we can prioritize those areas of greatest importance to you and then begin to address them systematically.

Our Role as Your Personal Chief Financial Officer

This consulting process serves as our framework, but it is only the beginning. To ensure that your family’s most important financial issues are addressed as needed, we serve as your personal chief financial officer.

As your personal chief financial officer, we set the foundation of your financial house through this investment plan. Once this is in place, we address additional components of your financial picture as needed. With your wealth management plan to guide us, we focus on five broad areas of your financial life:

- Wealth preservation aims to produce the best possible investment returns consistent with your level of risk tolerance and time frames.

- Wealth enhancement minimizes the tax impact on your financial returns and overall plan.

- Wealth transfer intends to find and facilitate the most tax-efficient way to pass assets to succeeding generations, and to do so in a way that meets your wishes.

- Wealth protection is aimed at protecting your wealth against potential creditors, litigants, children’s spouses and potential ex-spouses.

- Charitable giving helps fulfill your charitable goals and is most effective when coordinated with the four services above.

In accordance with your stated priorities, we will raise these issues and make our recommendations to you during our Regular Progress Meetings. Over time, this allows us to address all of your advanced planning needs.

Our Network of Professional Advisors

To gain the precise expertise we need to serve as your personal chief financial officer and effectively manage all aspects of your financial affairs, we work with a network of professional advisors. These carefully selected professionals provide us with a high level of knowledge and skill in key aspects of your finances. As your wealth manager, we review your complete financial picture and identify any needs. As appropriate, we then turn to our network in order to evaluate your specific financial challenges and devise appropriate recommendations.

Our advanced planning team reviews client plans, conducts a gap-analysis, and provides specific recommendations as an additional service with no extra cost. This team includes:

- Lawyers

- Accountants

- Business Insurance Risk Specialists

The Investment Plan

Your investment plan consists of three key parts:

- An analysis of your current situation

- A detailed description of your most important financial goals

- Our recommendations for achieving those goals

Our Recommendations

We used five steps to develop our recommendations for your investment plan:

- Assess your goals and circumstances.

- Set long-term investment objectives.

- Plan your asset allocation.

- Select your investment approach.

- Build your portfolio.

The following factors are included in each client’s comprehensive plan:

- Target Asset Allocation

- Tax Considerations

- Cost Ratio Considerations

- Recommended Repositioning of Portfolio

- Factors Considered in Portfolio Construction

- Future Liquidity Requirements

Tax Savings Specialization

An integral part to the success of a proper financial plan for family businesses or wealthy individuals is recommendations for the business’ tax requirements.

Are you confident that your business isn’t paying more tax than it needs to?

At Fischer Financial Services, we intimately understand the best tax-saving options for family enterprise, including a tax-efficient transfer to the next generation, and have helped many family businesses implement them to save significant income over years’ of operation. Many independent advisors or banks do not have this level of understanding and cannot properly advise on tax savings.