Here is a thoughtful piece by Imran Usmani, CPA, CA at QV Investors, Inc., where he offers insight and advise on investment and risk management. A well written article, worth sharing!

Keeping it Simple

“It’s tough to make predictions, especially about the future”- Yogi Berra

The start of 2016 coincided with my half year anniversary at QV. My six months at the firm have been full of learning. One early piece of advice I received from our President Joe Jugovic was to “try and keep it simple.”

Joe’s suggestion reminded me of a speech given in 1981, by Dean Williams of Batterymarch Financial Management. In his speech, Mr. Williams challenged some broadly accepted notions using simple analogies, examples and anecdotes. One idea that stood out for me was his comparison of physics and investing. Dean describes investing as being more like quantum than Newtonian physics. According to Dean, the foundation of Newtonian physics was that all physical events are governed by laws that we could understand rationally. With the arrival of quantum physics, evidence began to mount that events at the sub-atomic level are not subject to rational behavior or prediction.

The current Fed and interest rate saga is a good example of events that are difficult to predict. Just a few months ago we were inundated with predictions of the Fed rate hike trajectory. We now find ourselves in a world where discussions of deflationary risks are on the rise. Over the past month, for example, the implied probability of the Fed funds rate going negative by the end of 2017 has jumped to roughly 13% from just over 2%, data from Bloomberg shows.

Numerous studies conclude that humans are not very accurate when it comes to foretelling the future. The market is no different and its forecasting ability, or rather lack thereof, was the subject of a famous quip by Nobel Prize winning economist Paul Samuelson. He once wrote that stock markets have predicted “nine out of the last five recessions.”

At QV, we humbly admit that we are poor forecasters. We keep abreast of macro-economic news and try to assess how it could impact our portfolios, but refrain from hard projections of economic or market variables. We try to turn down the macro “noise” but are cognizant of opportunities that this noise may create.

Varian Medical Systems, a holding in our Global Equity Fund, highlights a quality company whose results have been negatively impacted by the strong US dollar. Varian’s base business provides hardware and software products for treating cancer with radiotherapy. There were 14 million people diagnosed with cancer in 2012, and this number is expected to increase to 20 million by 2025. Radiation therapy ranks high for the treatment of cancer when efficacy, cost and time effectiveness are considered. The company controls more than half of the radiotherapy equipment market and its core underlying order trends remain positive.

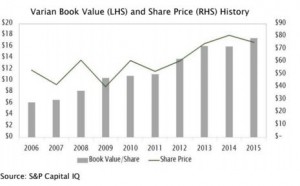

Varian’s technological advantage over its peers, the interconnectivity of its products with older competitor equipment and high switching costs have allowed it to generate considerable returns on its capital while creating tremendous value for its owners. The resulting “economic moat” has allowed management to grow book value at a compound annual growth rate of more than 10% over the past decade.

Varian is a classic example of what we believe is a strong company where the external challenges are masking the underlying quality of the business. At QV, our investment and risk management process helps us stay disciplined and “keep things simple.” We concur with Yogi Berra and will let other experts deal with the unfavourable odds of predicting the future. In the meantime, we will continue to stick to what we know best: investing in sustainable businesses and managing our portfolio valuations to minimize downside risk.

Leave a Reply