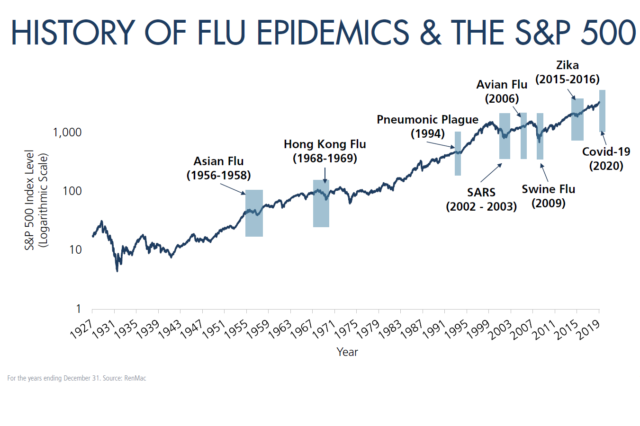

Since the start of my career as a financial planner this is the 4th significant pull back in the financial markets. We recommend portfolio managers have a balanced, dividend strategy for our clients, although the asset mix will vary by risk tolerance. Our clients’ portfolios have fared better than the overall market. What I find interesting is the hysteria that comes along with these events; mankind often over shoots the event when it comes to financial markets, either through sheer exuberance or overzealous pessimism. I do not wish to downplay the risk of the virus, but we have seen this financial picture before and below you will find a couple of charts illustrating this point. We are here to answer any concerns or questions you may have.

We wish you health and safety during this difficult time.

Sincerely,

Vern Fischer

Special Reports

At Fischer Financial Services, we trust our partners and value their expertise and professionalism. Which is why we wanted to take some time to reassure you about your investments and share some of the information we agree with from our valued partners, including,

- BCV Asset Management

- Successful Investor Wealth Management

- Value Partners Investments

- Guardian Capital

BCV Asset Management Bulletin

With current market circumstances we recommend clients reduce fixed income positions and add to equity exposure. Our focus is on meeting the long-term goals of our clients and making rational investment decisions, even when markets are occasionally irrational. With the passage of time, capital markets will regulate and clients will be rewarded for holding well run businesses in their investment portfolio. We know this will eventually subside and the best course of action is to maintain high quality securities in your investment portfolio that pay dividends through the ups and downs of capital markets. Consistent with our philosophy and strategy, we look at this market downturn as an opportunity to add high quality businesses to investment portfolios. Taking advantage of the price depression with an outlook of future growth. The best thing an investor can do is stick to their long-term financial plan and make adjustments once this volatility and market decline has passed. This should be done in conjunction with one’s financial planner or advisor.

Source & more information: https://bcvassetmanagement.com/

Successful Investor Wealth Management Inc

In a sudden and deep stock-market drop like the one of the past few weeks, it’s all too easy to respond impulsively or go to extremes. You may feel a temptation to sell all your stocks and “wait for things to settle down” before going back in the market. Or you may feel an urge to “average down”: buy more of your biggest losers. That way you lower their average cost, even if you have to borrow.

When you’re tempted to do something like that, it’s best to get re-acquainted with the first principles of investing.

- There’s a large random element in the stock market, as in human activity generally. If you react to stock-price changes impulsively or emotionally, you multiply the effect of that random factor.

- It’s a mistake to buy or sell stocks just because they have gone up or down. That’s because of the large random element in stock-price direction. Investing in a random fashion almost inevitably costs you money in the long term.

- People guess right on various topics every day. Random events like winning guesses tend to occur in bunches. However, nobody can predict the future with any consistency.

- Conflicts of interest have a big impact on what people believe, recommend, say and do. This is especially true if there’s money involved.

- History never quite repeats itself in the stock market, but often seems like it’s about to do so.

- A rising market climbs a “wall of worry.” Each brick in that wall—each new investor worry that comes along—could lead to a massive market decline if it continued for an unusually long period, and/or continually gains strength, rather than tapering off as most market worries do. That’s why you need to resist the urge to get out of the market during temporary downturns.

- You need to be aware that at crucial times, the stock market acts as if it is going to do whatever is necessary to fool the largest number of people who hold strong opinions.

- To succeed as an investor, you need to consistently follow investment practices that have paid off for large numbers of investors over long periods. If you take big risks—bet on long shots—you are likely to lose.

- To make money in the market, you should only invest in stocks when you can afford to and intend to hang on to them for a lengthy period, perhaps two to five years. Your plans may change due to circumstances you can’t control, of course. But if you go into the market without committing to a lengthy stay, you are at risk of selling impulsively during the next short-term market downturn. Do that and you are likely to lose money.

Source & more information: https://www.tsinetwork.ca/wealth-management/

Value Partners Investments

Your Wealth Continues To Grow Uninterrupted

There is a difference between a business and a stock. The value of a business is determined by its assets (both hard assets like land, buildings, manufacturing equipment, etc. and soft assets like people, processes, patents, intellectual property, access to financing) and its ability to generate profit with those assets. In contrast, the value of a stock is simply the price a bidder and seller (knowledgeable or otherwise) agree to transact at. Every business you are invested in through Value Partners has assets that would be considered desirable to any reasonable person and profits that are likely to continue and grow for decades to come. The Coronavirus is not the first global health scare to affect these businesses (think SARS, Avian Flu, Norwalk virus) and it is certainly not one of the largest challenges they have faced in their decades (or centuries) of successful operation through world wars, economic depressions and technological revolution.

Today’s Actions Determine Tomorrow’s Circumstances

This is true in the context of investor behaviour (if you sell and lock in a 20% loss, and then wait for the recovery before deciding to become a business owner again, your results will be radically worse than the investor who continues to participate in the profits of the wonderful businesses they own, or, increases their ownership stake at lower prices) but it is also true in the context of the actions the businesses themselves take! The Coronavirus will not change humans’ desire to travel and experience our incredible planet. It will not change our need for financing of a new home or growth capital to expand our business. It will certainly not reduce businesses drive for improved efficiency and increasing demand for capturing and interpreting data to improve the customer experience. What it will do is temporarily affect daily activities, creating pent-up demand AND it will create opportunities for those best positioned to create a better future.

Opportunities From Adversity

1) Banks and credit card companies benefit from a move to contactless payments – the Coronavirus highlights the health risk posed by cash.

2) United Parcel Service is the only global logistics company with drones equipped to deliver time-sensitive vaccines and approval from the Federal Aviation Authority to do it!

3) Streaming services poised to benefit from self-isolation. While Disney gets punished for closing their theme parks (a temporary situation) it will likely speed up trial and adoption of their streaming service (an ongoing subscription cashflow stream).

Government and Central Bank Actions

Around the world, governments are responding with increased spending, lower interest rates and potentially lower corporate taxes. All of these responses will serve to pour fuel on the natural recovery 6-12 months from now.

Source & more information: https://www2.valuepartnersinvestments.ca/

Guardian Capital

- Central banks around the world are slashing interest rates. The Bank of Canada made a surprise 50bps cut on Friday, the Fed has returned to its zero lower bound on Sunday evening and several monetary policy authorities in the Asia-Pacific region followed suit as the sun rose on Monday. These officials are also making forays into financial markets. The Fed is committed to buying at least $700 billion of government-backed securities ($500 billion in Treasuries and $200 billion in mortgage-back securities); while the likes of the Reserve Bank of Australia are hinting at a willingness to dip their toes into bond-buying to ensure markets maintain liquidity – and making coordinated efforts to alleviate any potential market funding pressures.

- The hope here is to provide support to financial institutions worldwide (ensuring that a health crisis does not morph into a financial crisis) and make funding cheap and readily available to help stoke grease the gears of the global economy. This will help the machine get back to full-speed in short order once the coast is clear.

- Governments, for their part, are announcing their commitments to throw money at the problem as well. The Canadian government announced $10 billion will be provided in funding to the Business Development Bank of Canada and Export Development Canada (EDC), to facilitate lending activities and trade financing, while also stating that further fiscal stimulus measures would be introduced in the coming week. The US has a House bill to be tabled in the Senate this week (which includes paid sick leave but only for about 20% of employees, free coronavirus testing, and support to states), and there are expectations that more measures will come. Even the traditionally tight-fisted Germans have pledged to spend whatever is necessary to protect its economy, as the European Commission agreed to ease fiscal rules and redirect budget funds to allow member states to invest in their economies and health sectors as well as address the sanitary emergency.

- It is undeniable that the risk of a recession has spiked in just this last week alone amid the spread of the contagion and resultant widespread cancellations. But, it is still important to note that should we see the contraction of economic output that meets the definition of a recession, this would be a very different variety than what we have experienced in recent history.

- The last two global economic downturns were precipitated by significant imbalances in the marketplace – the tech bubble in the early 2000s, and the housing bubble in 2007/08. These duration of these types of recessions is dependent on how long it takes for these imbalances to get back into balance – and as we saw in the aftermath of the crash of the housing bubble (that put innumerous households financially underwater), that can be a long and drawn-out period for demand to recover.

- In contrast, a downturn that results from an unforeseen event like a natural disaster or a, say, global pandemic (what economists refer to as an exogenous shock) results in a supply-side shock. In essence, demand has not materially eroded, but there are sudden outside factors affecting the ability of business to return to normal. As such, once those external forces have subsided (the hurricane has passed, or the rate of contagion has ebbed), activity is able to normalize fairly quickly, resulting in a quick snap back in economic momentum.

- While we are facing an unprecedented next few weeks, we can at least take some solace in the fact that this style of recovery from a health crisis does have precedent – such an outcome would be consistent with previous outbreaks. Research on instances ranging in severity from severe acute respiratory syndrome (SARS; which had 8,096 cases globally and resulted in 774 deaths) in 2003, to the Spanish Flu in 1918 (which afflicted nearly a third of the world’s population and killed 40 million people worldwide), suggests that the overall economic impact is typically short-lived and fairly limited from a longer-term perspective.

- That said, at the moment we are facing heightened uncertainty. As a result, the breakneck volatility that we have seen in financial markets over the last few weeks should not be expected to dissipate in the coming days, with prices for all assets to continue to whipsaw daily.

Such market swings can make life even more uncomfortable than the thought of self-isolation already does, but I again draw upon historical precedent and caution against investors selling into a panic. Such decisions historically have only ended up having a negative impact on wealth in the long-run. - Rollercoasters may well make you uncomfortable, but once you are strapped into the car it is best to just close your eyes and hold on tight until the ride comes to a complete stop; it is typically only the people that try and get off in the middle of the run that end up getting hurt.

Source & more information: https://www2.valuepartnersinvestments.ca/

Client Meetings Continue

We recognize that face-to-face meetings at this time may not be advisable or possible. However, rather than cancel, we recommend using technology to continue with planned discussions so that we can stay on track with your investment and insurance interests. We are experienced with web and telephone conferences and will set them up as seamlessly as possible for our clients to join.

Call or email us to set up a virtual meeting:

250-220-8441

Vern Fischer: v.fischer@fischerfinancial.ca

Julie Polack: j.polack@fischerfinancial.ca