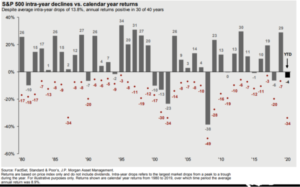

We are actively re-balancing based on market circumstances. The following is an example of what we expect our portfolio manager partners to be doing for our clients:

- In late 2019 and early 2020, as markets touched new all time highs, we were re-balancing portfolios. We were selling equities where overweight and buying fixed income. Portfolio positioning: neutral fixed income and equity weights versus target.

- As the markets touched lows on Monday March 23, 2020 due to COVID-19, we were in the throws of, once more, re-balancing portfolios. We were selling fixed income where overweight, and buying equities. Portfolio positioning: overweight equities versus target.

- In late August / early September 2020, markets having recovered nicely off of COVID-19 lows (the S&P500 flirting with new highs), we began re-balancing portfolios to unwind the overweight equity position established in March. Portfolio positioning: neutral fixed income and equity weights versus target.

- Added international exposure late in August / early September 2020:

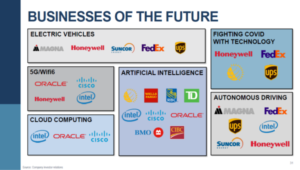

- Technology companies have been the out-performers throughout the COVID-19 recovery. As we believe technology will continue to play a more elevated role in society as social isolation / distancing remains in place, this out-performance can be expected to continue moving forward.

- Already having exposure to the Apple’s and Google’s of the world through our US and Global strategies, we looked for some diversification in markets that are showing us more value.

- The international market (EAFE – Europe, Australasia and the Far East; the most developed geographical areas of the world outside of the United States and Canada) fit the bill:

- Our international strategy has a 36% concentration in technology names (vs. our US strategy 29%).

- The international markets also present us with a better value play, having not yet seen a full recovery off of COVID-19 lows.

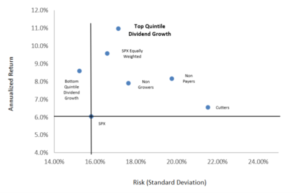

Why do we recommend dividend growing companies and equities in a conservative portfolio?

The recent market growth, in both Canada and US, has been dominated by a narrow range of companies: in Canada it’s Spotify and gold companies, in the US it’s a select few technology companies. Some interesting facts: the market value of Spotify is higher than the Royal Bank of Canada, yet Spotify loses money and the Royal Bank last year made $14Billion in net profits. The top technology companies in the US S&P500 have a market value higher than a lot of countries.

“Within Canada, small cap, gold stocks have dominated performance since the start of March. These themes have been ignited by the pandemic, creating significant divergences within the market. For example, consider Tesla versus Telus. Tesla has been a poster child for recent market indulgences, with the shares gaining over 300% since the start of the year. When measured against nations, the company’s market cap now sits on par with Singapore, exceeding the GDP of three quarters of the world’s countries. Meanwhile, Canadian telecom company Telus, despite displaying stability throughout the pandemic, has been left in electric vehicle dust, declining slightly year-to-date. This dynamic feels a lot like 1999 when old economy stocks, despite sound fundamentals, underperformed more “exciting” growth stories by a sizeable margin.” QV update Oct 5, 2020

The point is to own great companies that produce great profits and not pay too much for them. In the long term this is the winning formula, although admittedly not as exciting as owning Telsa or Spotify.

Volatility is the nature of the stock market, but overall long term will outperform any other investment

You don’t need to overpay or own the sexy companies to be an owner of businesses of the future economy

Want to discuss your portfolio? Set up an appointment at your convenience:

Please stay safe and stay healthy.

Vern Fischer