Key Takeaways:

- Founders of family businesses and single-family offices care more about family harmony then do their heirs.

- Professionals—from psychologists to wealth managers—can help families build better relationships.

- Families themselves can work together to spell out and implement their shared values.

The ability of family members to get along and be supportive is a goal of a great many families irrespective of their wealth. If you have children or an extended family that spans generations, chances are you’d like to see those family members “play nice” together and have harmonious relationships—with you and with each other. After all, who among us actually wants to live with a pack of squabbling relatives?

But do your children, grandchildren or other heirs feel the same way—or feel as strongly as you do about family harmony? A look at the attitudes of the very wealthy suggests they might not.

Here’s a chance to examine your own family’s beliefs about their interpersonal relationships—and perhaps find some ways to boost interest in creating a happier, smooth-running family. In particular, if you are closely involved with other family members in a business or in overseeing other financial assets, you’ll want to compare your views with those of the ultra-wealthy.

Generational gaps

When it comes to different generations among the very wealthy, we find that older family members—such as matriarchs and patriarchs—tend to value family harmony differently than do the younger set.

For example, consider two segments of the ultra-wealthy that typically have relatively large families: those who operate family-run businesses and those who have set up single-family offices to manage their financial (and often, personal) lives. With respect to those cohorts with family enterprises to oversee, there is often an array of complications to getting along and serious possibilities for severe conflicts that can harm family relationships—as well as their single-family offices or family businesses.

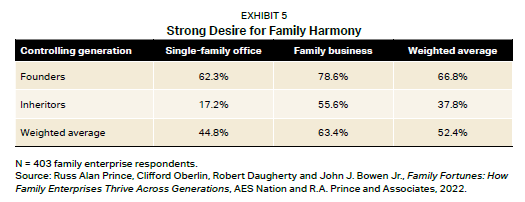

Slightly more than half (52.4 percent) of the family enterprise respondents in our research have a strong desire for family harmony (see Exhibit 5). That said, this desire is proportionately significantly greater among the founders than the inheritors. It is also much more pronounced within family businesses than single-family offices.

The generational difference between single-family offices with respect to family harmony is especially striking. Nearly two-thirds of the founders’ single-family office senior executives (62.3 percent) say they strongly desire to see family harmony. In stark contrast, somewhat less than one-fifth (17.2 percent) of single-family office senior executives in the inheriting generation agree.

One possible reason: It is a major transition when single-family offices are passed to the next generation. Very often the founder wants to hold his or her family together. This may be much less likely to be the case with the heirs, who many times have significantly different views than their parents in key areas (such as how to invest the family money, for example). Disgruntled inheritors may very well disengage from the single-family office, potentially eliminating the perceived need to take steps to promote family harmony.

In family businesses, however, it is often much harder for inheritors to cut ties and “go their own way” (and they are often much less willing to do so). The business is the source of the family wealth in most instances, and there may be no other comparable wealth-generating options available to the heirs. Therefore, striving for family harmony might be the best outcome for the continuation of the family business—and the family’s bottom line.

It is very easy for family conflicts to disrupt and sometimes destroy significant family fortunes. The ability to make sure all the key family members are on the same page when it comes to major decisions can be critical to the success of a single-family office as well as to ensuring the family business runs effectively.

Using legal tools to ‘encourage’ harmony

Some families have engaged in specific planning that incorporates family relationships and behavior. About 40 percent of the family enterprise respondents have created financial succession plans that address multiple future generations. In doing so, many of them likely believed their actions would promote family harmony—or, at least, some degree of family cohesion. Such an approach is often necessary to create a family dynasty.

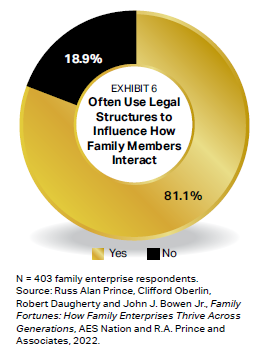

According to the elite private client lawyers, it is a fairly common practice for the ultra-wealthy thinking about multiple future generations to put certain legal structures in place. The lawyers also report that these legal structures often influence family members’ behavior when it comes to the family enterprises (see Exhibit 6).

Four out of five of the elite private client lawyers reported that they often set up legal structures for some ultra-wealthy families that dictate how family members need to work together. In these scenarios, family harmony (in the sense of everyone getting along well) is potentially made moot. Of course, there are varying degrees to which the legal structures can dictate behavior, but they likely manage to impose some degree of restraint or influence.

Engaging professionals to facilitate family harmony

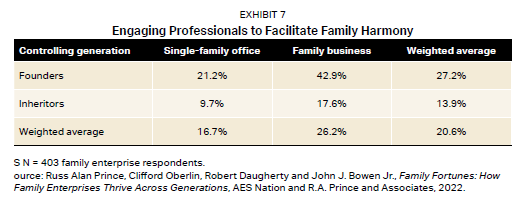

Relatively few single-family office senior executives or C-level ultra-wealthy family business owners have engaged a professional to explicitly facilitate harmonious relationships between family members. However, there are once again some striking gaps (see Exhibit 7).

About one-fifth of senior management at the founders’ single-family offices, but less than one-tenth of the inheritors’ single-family office senior executives, have hired professionals to deal with this matter. Such professionals could include, for example, life coaches, family therapists and family business consultants.

However, using these professionals is significantly more common among ultra-wealthy family businesses. Yet even here, the first generation is far more likely than the second generation to have engaged these types of consultants.

While most single-family office senior executives or C-level ultra-wealthy family business owners are not specifically hiring professionals to address matters of family harmony, many times other professionals (such as wealth managers, bankers, attorneys and accountants) are involved in dealing with these issues. Technically, while they are not being paid for this service specifically, their work in facilitating family harmony is intertwined with their core expertise.

Consider that about three-quarters of the elite private client lawyers surveyed said they have been involved in helping ensure harmony within their clients’ families. For them, this service is part of the job.

Evaluate your situation

Where does all this leave you, especially if your net worth isn’t approaching the ultra-wealthy level? These patterns among the very wealthy can help inform your thinking and approach toward harmony within your own family.

For example, you might assume that your children feel the same way you do about the importance of family harmony. But the research suggests that they may not. Knowing where your family members stand in terms of their interest in (and desire for) harmonious family relationships is a good place to start. This can be especially important if you work in partnership with family members in a business or other venture, because as noted, that venture may be important to the financial futures of you and your heirs.

From there, you can determine whether you want to bring in various resources that aim to encourage younger generations’ interest in family harmony—and increase actual family harmony itself. Numerous financial and interpersonal tools exist that can help you pursue these goals. A few examples:

- Legal structures. As noted, you can set up trusts or other types of legal structures that use a carrot-and-stick approach to bringing harmony to your family—or at least behaviors that you want to see your family members engage in.

- Outside professionals. Family coaches, consultants, psychologists and other professionals focus on the social aspects of promoting family harmony, often by seeking to work through family dynamics as a way to help ensure stronger bonds.

- A family constitution. Families themselves can craft their own form of constitution that spells out their shared values on a wide range of topics and how they want to work together to implement and “live” those values. This can be done at one or more family meetings, where family members gather formally to discuss and hash out important details of their beliefs and shared interests.

ACKNOWLEDGMENT: This article was published by the VFO Inner Circle, a global financial concierge group working with affluent individuals and families and is distributed with its permission. Copyright 2023 by AES Nation, LLC.

This report is intended to be used for educational purposes only and does not constitute a solicitation to purchase any security or advisory services. Past performance is no guarantee of future results. An investment in any security involves significant risks and any investment may lose value. Refer to all risk disclosures related to each security product carefully before investing. Securities offered through Fischer Financial Services. Vernon Fischer is a registered representative of Fischer Financial Services. Vernon Fischer and Fischer Financial Services are not affiliated with AES Nation, LLC. AES Nation, LLC is the creator and publisher of the VFO Inner Circle Flash Report.

Get in Touch!

Set up an appointment at your convenience: