Key Takeaways:

- A family bank is a formal legal entity that a family sets up, with rules that govern how family members can access family funds.

- Family banks often are designed to help support entrepreneurship among family members.

- Family banks tend to do best when they’re customized around the needs of the family.

A foundational objective we see among many single-family offices serving Super Rich families is to enable future generations of family members to build their own wealth and create their own entrepreneurial legacies.

With that in mind, the Super Rich are embracing ways to develop the business acumen of inheritor family members—as well as ways to support them in forming new ventures of their own.

One way the Super Rich are making that happen is through family banks. And increasingly, families that aren’t as wealthy as the Super Rich are using these banks as well. Here’s a look at how family banks work, so you can start to consider whether they make sense for you and your goals.

A way to generate family wealth—and family financial intelligence

A family bank is a formal legal entity a family sets up, with rules that govern how family members can access family funds as well as how those family members are expected to pay back that money. In general, older family members provide funds to the family bank for the purpose of helping fund younger family members’ pursuits—which might include starting or supporting business ventures, attaining higher education, and other interests or needs.

Family banks are designed to bring a level of structure, professionalism and accountability when providing money to family members to fund initiatives—and minimize the type of emotion-based lending that often occurs in families. As such, family banks can help instill financial intelligence, financial responsibility and financial values in family members—while also helping avoid accusations of favoritism in families with multiple children.

Consider, for example, how a family bank might approach the issue of a child’s college tuition. Rather than simply writing a check to the university, a matriarch or patriarch could require the college-bound child to apply for a loan that would cover 50 percent of the amount needed. The loan term could include a requirement that the child then work during weekends, breaks and summers to make loan payments. Having this type of “skin in the game” could potentially influence how the child views the importance of his or her education, as well as how the child thinks about money and spending in general.

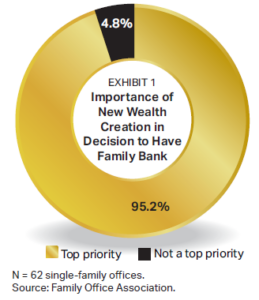

Certainly, family banks have one clear and overarching goal: creating new wealth. As seen in Exhibit 1, a full 95 percent of the single-family offices that have established family banks (as well as those that employ a defined process without a formal family bank structure) say “new wealth creation” is a top reason for having a family bank.

The concept of the modern family bank dates back to the founder of the Rothschild dynasty, Mayer Anschel Rothschild. To protect his heirs from the problems created by inheriting significant personal fortunes, he decided the Rothschild fortune was to be used for the education of heirs as well as investment—including new ventures. Rothschild inheritors were expected to grow the family fortune by making their own way in business, backed by the family’s resources.

Today, family banks are structured and used in a few ways:

- One use of the family bank is to provide short-term loans to family members who have experienced a personal setback. The moneys are intended to help them get back on their feet.

- Another is to loan money to family members for business ventures that can potentially generate additional family wealth.

Fostering growth from new family businesses

Increasingly, family banks created by the Super Rich are focusing on promoting and supporting entrepreneurship among family members who inherit wealth. The funds provided by a family bank are intra-family loans, equity investments in the new entrepreneurial ventures or both. For example, a patriarch might loan his daughter money through the bank so she can start a consulting business. The daughter agrees to repayment terms at a preferred rate.

Additionally, many family banks are designed to foster the creativity and capabilities of the next and future generations—in essence, to build human capital along with financial capital. Therefore, some family banks incorporate formal and informal entrepreneurial education and mentoring support.

Danger: Beware of taking an informal approach. About 60 percent of these exceedingly wealthy families are supporting the entrepreneurial activities of subsequent generations through informal arrangements that lack legal documentation—usually gifts or intra-family loans. Informal arrangements greatly increase the possibility of family conflict. For example, two or more family members might, and often do, remember agreed-upon financial arrangements differently. These situations can easily become destructive to family unity—such as when the senior family member dies and there is no documentation concerning the existence or terms of intra-family loans that he made.

Important: With family banks, accountability is paramount. Family banks are not just pools of money that family members can draw on as they see fit. Obtaining funds from a family bank is very much akin to getting funding from a venture capital firm or commercial bank: The transaction must meet established criteria and be well documented.

The need for customization

Family banks, like single-family offices, are not cookie-cutter entities. They tend to do best when they’re customized around the often idiosyncratic nature of the particular wealthy family as well as the family’s specific circumstances. That is why some exceptionally wealthy families with single-family offices choose to establish and run stand-alone family banks while others run the process through their single-family offices without setting up another entity. It’s all a matter of the particularities of the situation.

Flexibility is key. Family banks tend to evolve from being very simple to fairly complex. It’s wise for family banks to have plenty of built-in flexibility when they’re established so they can adjust as circumstances change.

Example: Consider one single-family office started by a Super Rich multigenerational family. What started off as a formal process for them to provide intra-family loans over time morphed into a family-only venture capital firm able to deliver a diverse range of sophisticated financing strategies.

Solutions for the not-so-Super Rich

All this said, family banks are not the exclusive domain of the extremely wealthy. Families with considerably less wealth can also use a family bank as a lending and investment vehicle to support the commercial activities of their heirs.

Whereas the exceptionally wealthy move assets around in order to fund their family banks, those less wealthy are not always in such a financial position. Instead, they may need to build a pool of money that family members can use.

Example: A family could use the tax-free buildup from certain types of life insurance to amass wealth that family members can then use to fund their own entrepreneurial ventures.

Conclusion

Family banks are one tool that many wealthy families use to foster a culture of entrepreneurship and financial responsibility among children and grandchildren—as well as create new wealth for the family coffers. You may wish to explore whether a formal family bank or family bank-style arrangement meets your particular goals and family dynamics.

You may find a family bank to be a valuable resource that builds both a stronger family legacy and larger bottom lines for you and your loved ones.

Tapping the right expertise

Family banks created by the same Super Rich families that set up single-family offices regularly make use of experts to assist and advise them—including wealth managers, lawyers and accountants. Generally, these families look for experts with a few key characteristics:

- Insights and experience with wealthy inheritors. Familiarity with family dynamics and an understanding of the perspectives, needs and wants of the next-generation wealthy are essential to ensuring accountability and a meaningful return on investments.

- Expertise in and experience with entrepreneurship. The ability to provide tactical guidance in making investments in private enterprises and helping them grow is critical in supporting inheritors.

- Tax mitigation expertise and experience. The exceptionally wealthy make considerable use of tax specialists to minimize income and estate liabilities. With new ventures, there can be substantial opportunities to reduce current and future taxes.

- Independent and conflict-free advice. Advisors need to be independent without a stake in the process, save for helping the inheritors and the companies.

ACKNOWLEDGMENT: This article was published by the VFO Inner Circle, a global financial concierge group working with affluent individuals and families and is distributed with its permission. Copyright 2023 by AES Nation, LLC.

This report is intended to be used for educational purposes only and does not constitute a solicitation to purchase any security or advisory services. Past performance is no guarantee of future results. An investment in any security involves significant risks and any investment may lose value. Refer to all risk disclosures related to each security product carefully before investing. Securities offered through Fischer Financial Services. Vernon Fischer is a registered representative of Fischer Financial Services. Vernon Fischer and Fischer Financial Services are not affiliated with AES Nation, LLC. AES Nation, LLC is the creator and publisher of the VFO Inner Circle Flash Report.

Get in Touch!

Set up an appointment at your convenience: